Publications

The Economics of Advice: Evidence from Startup Mentoring

Files: Main Paper | Supplemental Material

Management Science (2025)

ABSTRACT: This paper examines the role of advice in early firm development and growth, drawing on detailed data from a global program where angel investors and venture capitalists (VCs) mentored founders over several months. Leveraging variation in mentors' availability to support start-ups because of personal scheduling conflicts, I find that advice significantly improves start-ups' future market performance. To explore how advice shapes early firm development, I develop a novel typology of start-up activities, finding that a defining element of mentors' advice is to do less and learn more. Although angels and VCs are consistent in this message, they differ significantly in when they choose to advise start-ups in achieving their business objectives. Angels are more likely than VCs to help founders design and execute product market experiments, whereas VCs provide more mentoring support on business analysis and planning tasks. I find evidence consistent with the hypothesis that experimentation is a skill developed via learning-by-doing, and angels have a skill advantage in that domain because of having more operational experience.

Information Frictions and Employee Sorting Between Startups

w/ Kevin Bryan and Mitchell Hoffman

Files: Main Paper | Appendices | RCT Screenshots | AEA RCT Registry

American Economic Journal (forthcoming)

ABSTRACT: Would workers apply to better firms if they were more informed about firm quality? Collaborating with 26 science-based startups, we create a custom job board and invite business school alumni to apply. The job board randomizes across applicants to show coarse expert ratings of all startups' science and/or business model quality. Making this information visible strongly reallocates applications toward better firms. This reallocation holds even when restricting to high-quality workers. The treatments operate in part by shifting worker beliefs about firms' right-tail outcomes. Despite these benefits, workers make post-treatment bets indicating highly overoptimistic beliefs about startup success, suggesting a problem of broader informational deficits.

Working Papers

Price Theory of Silicon Valley

w/ John Horton

(preparing manuscript for resubmission to journal)

ABSTRACT: We model an entrepreneurial cluster as three interconnected kinds of markets: the market for venture capital, the labor market for high-skilled individuals, or “engineers,” and the product markets startups hope to serve. Engineers choose to either found a startup as an entrepreneur—pursuing a single business idea and obtaining seed funding from VCs in ex- change for equity—or join an established startup as an employee. The model predicts the equilibrium number of startups formed and their success probability, as well as the wages of engineers, the share of equity retained by founders, the fraction of engineers pursuing entrepreneurship, and the profits of successful startups. The equilibrium is affected by the cost of founding a startup, the extent of product markets, the supply of engineers, and the “supply” of startup ideas. The model predicts the total output of the entrepreneurial system and the social value of the marginal startup..

How does Industry Affiliation of Academic Scientists Affect the Rate and Direction of Research?

(manuscript ready for conference presentation)

ABSTRACT: The implications of academic collaborations with industry have long been the nexus of contentious debate. The prevailing concern is that industry causes research to lose its fundamental depth and become commercially driven. This paper presents evidence that these concerns are misplaced for areas of research that have commercial value--that is, the specific domains for which these concerns are raised. The empirical analysis uses large-scale, manually improved bibliometric data from artificial intelligence research. For identification, I use the unexpected and significant success of the neural network techniques revealed at the ImageNet 2012 benchmark competition, which sharply increased the industry's demand for AI scientists, but more so for scientists with higher expertise in the breakthrough field. While industry affiliation significantly increases the usefulness of research, it does not diminish its novelty. In addition, industry affiliation raises both the publication and the quality of science produced by academic scientists. Results are consistent with the explanation that, at least in the medium term, academics in short supply can negotiate higher academic freedom while utilizing commercial resources for their research.

Media Mentions: The Economist - Million Dollar Babies | The Economist - Battle of the Brains

Activity Sequencing in Startups

w/ Jorge Guzman

(preparing manuscript for conference presentations)

ABSTRACT: In this paper, we investigate the sequence of startup activities over time to understand the mechanisms underlying the prioritization of activities in startups. We leverage a novel typology of startup activities using a database early-stage, science-based startups. We show that entrepreneurs, particularly first-time founders, under-prioritize learning. Using Latent Markov Models, we show that the sequence of activities in early-stage startups from learning to implementation of ideas and acquisition of resources increases startups' success in accessing capital.

Work in Progress

[1] Scientific Decision-Making in Early Firm Formation and Growth, with Ajay Agrawal, Arnaldo Camuffo, Alfonso Gambardella, & Jakub Malachowski - data analysis

[2] The Effect of Disagreement on Learning: Evidence from Business Mentoring, with Luca Gius - data analysis

[3] The Effect of Noisy Learning on Startup Performance, with Joshua Gans, Erin Scott, & Scott Stern - data analysis

Other Work

[1] Sariri, A., Gatov, E., Neal, G., Robinson, K., Sennik, S., Tham, W. Y., Vertolli, M., & Goldfarb, A. (2025, August). Database, methodological tools, and research opportunities: Creative Destruction Lab and early-stage technology ventures (NBER Working Paper No. 34127). National Bureau of Economic Research. https://doi.org/10.3386/w34127

[2] Sariri, A. (2020). Activity sequencing in startups. Academy of Management Proceedings, 2020(1), 280. https://doi.org/10.5465/AMBPP.2020.280

[3] Sariri, A. (2019). How industry affiliation of academic scientists affects the rate and direction of research. Academy of Management Proceedings, 2019(1), 19569. https://doi.org/10.5465/AMBPP.2019.19569abstract

Database Development

Database, Methodological Tools, and Research Opportunities: Creative Destruction Lab and Early-Stage Technology Ventures

w/ Evgenia Gatov, Kyle Robinson, Sonia Sennik, Michael Vertolli, Avi Goldfarb

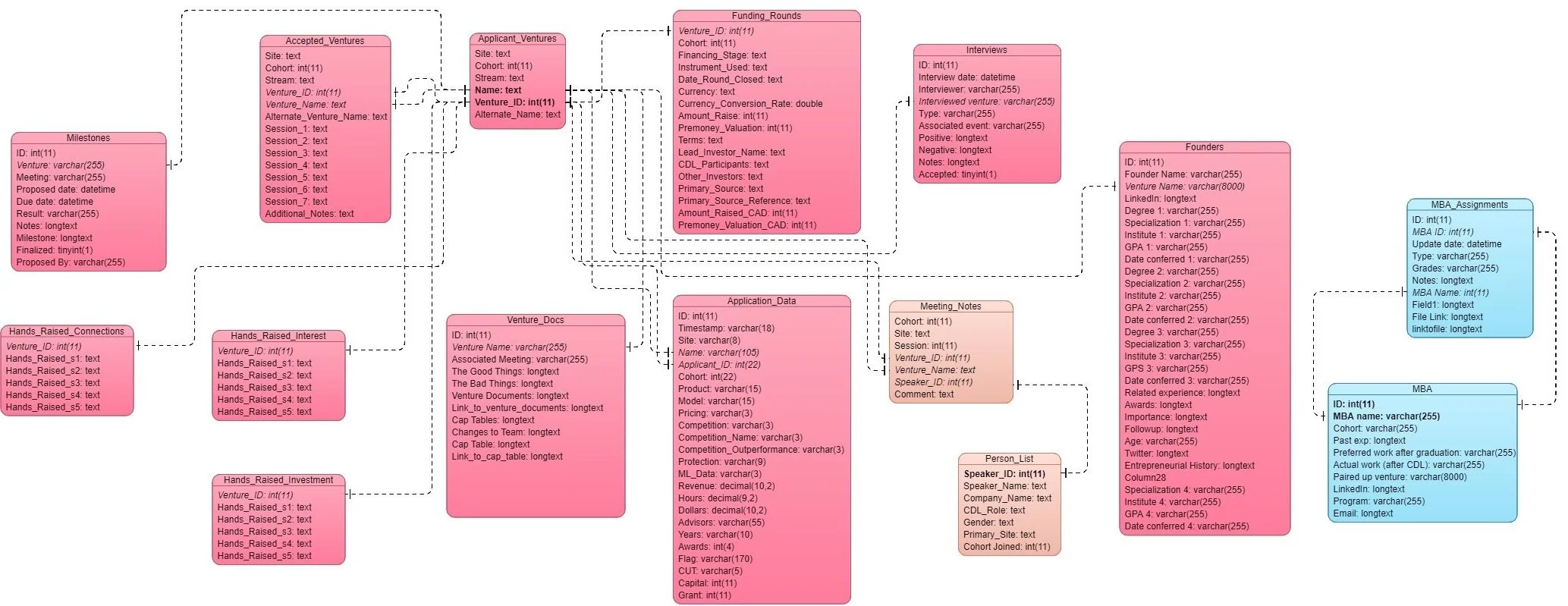

The early stages of startup formation remain one of the least understood aspects of firm development and growth. Decisions made during these formative periods often have irreversible consequences, shaping the trajectory and potential success of new ventures. However, these formative periods are also the most challenging to observe in a systematic way that allows rigorous empirical analysis. In this data collection project, we introduce new data built from Creative Destruction Lab (CDL), a global non-profit mentoring program for early-stage high-technology startups. We believe that the nature of this program and the richness of data we collected from its operations are particularly suited for investigating open questions in the economics and management of advice, entrepreneurial strategy, entrepreneurial finance, and the complex process of technology transfer.

As of 2024, there are 15 research projects that use these data by 18 scholars across Purdue University, University of Toronto, Harvard University, University of Chicago, HEC Montreal, HEC Paris, Dalhousie University, University of British Columbia, University of Calgary, and MIT. The projects that are published so far are:

- Amir Sariri; The Economics of Advice: Evidence from Startup Mentoring; Management Science, Forthcoming

- Álvaro Parra, Ralph A. Winter; Early-stage venture financing; Journal of Corporate Finance, 2022

- Per Davidsson, Denis Gregoire, Maike Lex; Venture Idea Assessment (VIA): Development of a needed concept, measure, and research agenda; Journal of Business Venturing, 2021

This data collection project was a part of my doctoral dissertation research and was tremendously supported by guidance from my advisors Ajay Agrawal, Joshua Gans, and Avi Goldfarb. I also received funding and support from Creative Destruction Lab, the Strategic Innovation Fund of the Federal Government of Canada, and the RBC Royal Bank’s Borealis AI Foundation.

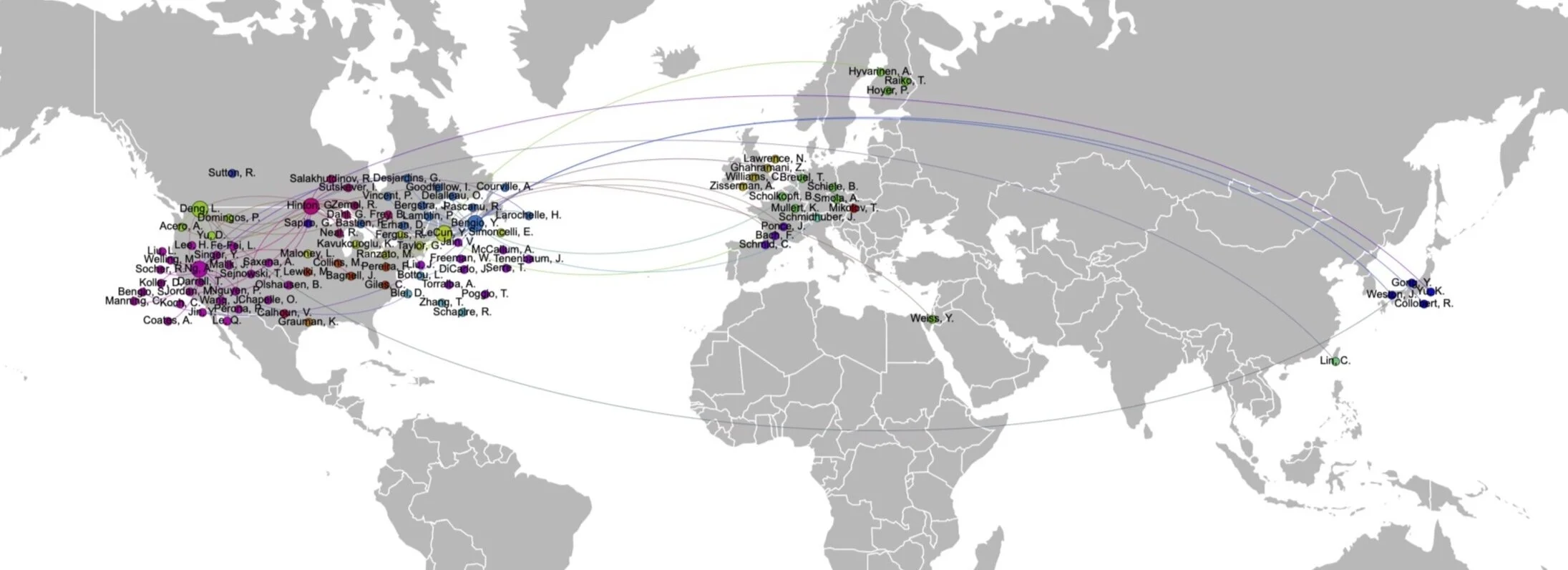

The Rate and Direction of Academic Research in Artificial Intelligence

Ajay Agrawal and I collected data on a decade of conference proceedings of major AI conferences to understand how the state of the labor market for AI scientists and the distribution of scientific productivity has changed since the 2012 ImageNet Competition.

Findings from these data were presented to world leaders from government, industry, and the scientific community at the 2015 Future of Life Institute conference. For an overview on this conference see this Washington Post article.